Tipping the Scales

34square provides contractor capabilities to optionally tip the scales firmly in favour of outside IR35...

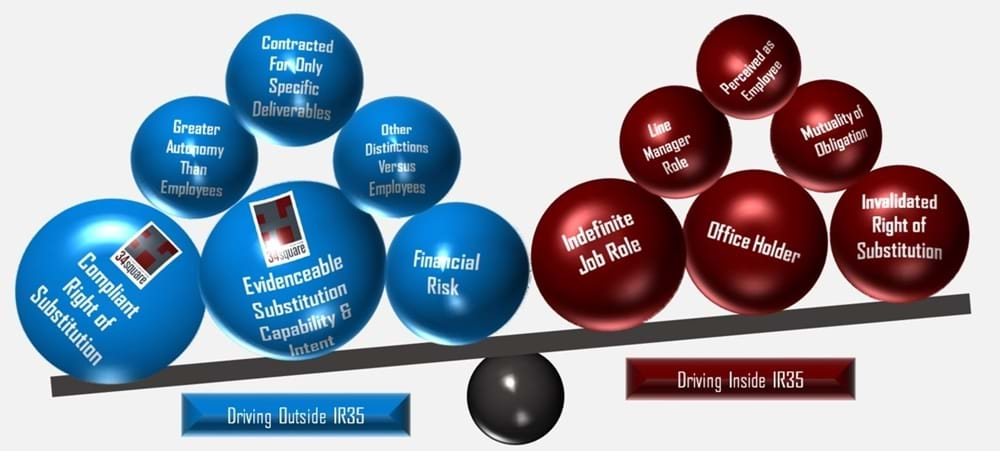

Tipping the Scales Outside IR35

Compliant Right of Substitution.

- Case law precedent supports right of substitution as a potential sole driver of outside IR35 status.

- For it to be compliant, the contractor must be the one that would / will / has engaged and paid the substitute.

- Further, the right must be irrefutable, such that the client cannot reject substitution other than for reasonable grounds that contracted services have been or will be unsatisfactorily compromised.

Evidenceable Substitution Capability and Intent.

- An evidenceable capability and intent to carry out a substitution in compliant manner adds further weight to the right of substitution.

- Contractors registered on 34square can demonstrate both.

Financial Risk.

Significant levels of financial risk can point firmly towards a contractor being in business on their own account and therefore NOT a pseudo-employee. Some examples of financial risk with varying levels of influence are as follows:

- Paying for non-commuting travel and accommodation in advance of being paid carries reasonable weight.

- Using one's own equipment, or paying for software or other necessary tools to provide the services are persuasive pointers towards outside IR35.

- Paying for materials in advance, in construction for example, or for substantial equipment or commercial vehicle costs, carries sufficient weight to drive firmly towards outside IR35.

- Paying for professional indemnity and public liability insurance emphasises additional responsibility in addition to the financial risk element.

- Being solely responsible for the expertise and capabilities required to deliver services, for example paying for one's own training, carries significant weight for the outside IR35 case.

- In the case of a substitute, if the worker has full responsibility to ensure the substitute is effectively prepared and on-boarded at their own cost, this strengthens right of substitution and financial risk.

Greater Autonomy Than Employees.

Examples of autonomy that help to distinguish contractors from permanent employees are:

- Greater freedom than employees to determine methods and approaches in delivering services.

- Greater autonomy than employees in determining locations and hours or times of day for the delivery of services.

Other Distinctions Versus Employees.

The following are examples of helpful differentiators of contractors versus employees:

- No entitlement to employee / corporate benefits.

- No responsibility for formally appraising employees and not subjected to appraisals themselves.

- No participation in employee-centric social and corporate events.

- Not present on official, published organisation charts.

Contracted For Only Specific Deliverables.

- A Statement of work that specifically lays out the scope and limits of a contractor's services is a helpful indicator of outside IR35, the more deliverables focused the better.

- A specifically contracted duration linked to the closure of a project, transformation or other change program points towards a contract of services and outside IR35.

Tipping the Scales Inside IR35

Invalidated Right of Substitution.

- Your substitution clause could be invalidated if your client refutes it, or even casts doubt over their buy-in.

- You could be challenged if you have no demonstrable capability to carry it out.

- Membership of 34square will help to safeguard you against this.

Director or Other Office Holder at Client.

- Having the word ‘Director’ in your title doesn’t necessarily mean that you are an office holder. A registered Director is an office holder. If you ARE an office holder in your client organisation, then you are automatically inside IR35, irrespective of any other factors. If you have director in your title, and are not an office holder in terms of HMRC’s definition, it still may attract attention to the nature of your duties and tip the scales firmly towards inside IR35. The HMRC definition of an Office Holder can be found here: https://www.gov.uk/employment-status/office-holder

Line Manager Role.

- Although not a guarantor of inside IR35 status, a line management role i.e. having others formally reporting to you, will weigh heavily in favour of inside IR35.

Indefinite Job Role.

- If a contractor is being engaged for what essentially amounts to an indefinite job role, then outside IR35 should not be a consideration as this essentially defines them as pseudo-employees.

- Interim roles are a prime example of this, but any position that lives on irrespective of the tenure of the incumbent likely qualifies.

Mutuality of Obligation.

- The established concept of client obligation to provide work for the contractor, and the contractor to perform it, is a firm inside IR35 driver.

- If the nature of the relationship between worker and end client is such that it is generally mutually accepted the engagement will continue and work will be sought and delivered irrespective of the status of any work actually specified in a contract, then this points firmly to pseudo-employment and inside IR35.

- A good example would be that many companies employ permanent project managers. The company expects the employee to manage any project it gives them to manage, and the employee expects to be supplied with an indefinite stream of projects. Further they expect to be paid if there is a downtime or quiet period between projects.

- That same company could engage a contract project manager outside IR35 for the delivery of a specific project with no expectation of any other scope to the relationship. This could be because there is no capacity amongst permanent employees or perhaps because specialist expertise is required that no employed project manager possesses.

Perceived Employment.

Various engagement factors or attributes could contribute to perceived employment status and therefore point to pseudo-employment and outside IR35, including:

- Contractor introducing themselves or being introduced to others as an employee of the end client.

- Contractor making a contribution to the end client that is essentially indistinguishable from that of one or more others that are in fact employees. As already talked about in the previous section, the absence of a mutuality of obligation would be sufficiently distinguishing.