IR35 AND WHINGING, MOANING CONTRACTORS

Enough already. They just need to suck it up.

If an organisation were to suddenly announce a 15% wage cut for all of its workers, what would they expect to reap in return? Loyalty? Hard work? Commitment? Passion? Doubtful. But at least that organisation would be saving 15% on their wage bill.

What if they just burnt that 15% of cash they saved? All that reduced productivity and dissatisfaction and not a single benefit in the mix. Why would any business leader capable of sound judgement make a decision like that, without exploring other options?

Contractors forced inside IR35 or into other PAYE arrangements, face take home pay reductions of 15% upwards, with nothing in return. It’s mainly about savings in NI contributions, the ability to immediately offset legitimate business expenditure, and being able to spread income across gaps between engagements. In tax terms, outside of NI, many or even most will be paying higher tax percentages than employees, due to the 7.5% additional tax on dividends.

Many clients are shrugging and saying put my contractor engagements through this or that assessment tool and they’ll just have to accept the outcome. These assessment tools are ten-a-penny. The result could genuinely depend upon which one you choose. That’s arguably not right or proper.

At the centre of this simple conundrum is apathy. Apathy breeds APATHY. And its evil sibling, COMPLACENCY. There is no place for apathy or complacency in successful businesses or successful business leaders. Complacency kills businesses. Slowly at first. Then suddenly, they’re gone.

If contractors are being engaged to deliver specific services associated with a business change, beyond which they will no longer be engaged, then legitimate, compliant, safe outside IR35 engagements are still a reality. At no cost or risk to clients or agents.

Contractors most reluctant to tolerate inside IR35 or any other PAYE solution, of which I am one, should speak out. It’s contractors that have built www.34square.com. With a foundation of over a thousand hours of IR35 research and legal advice. The embodiment of what industry seeks from us? Problem solving; creativity; resourcefulness; drive; RESULTS.

So, agents and clients… why not use us and keep contractors as committed and driven as they always have been? No lucky dip assessment tool. Just adopt the engagement and working practices criteria we prescribe. That’s it. Clients and agents pay no fees whatsoever. And clients get a full status determination statement (SDS) service, with workflow, electronic signature, signed acknowledgement of receipt by worker and fee payer, audit trail, secure storage and even a periodic reminder to review and re-issue. Even the mandatory SDS disputes process is included, not that you're ever likely to need it where we are involved.

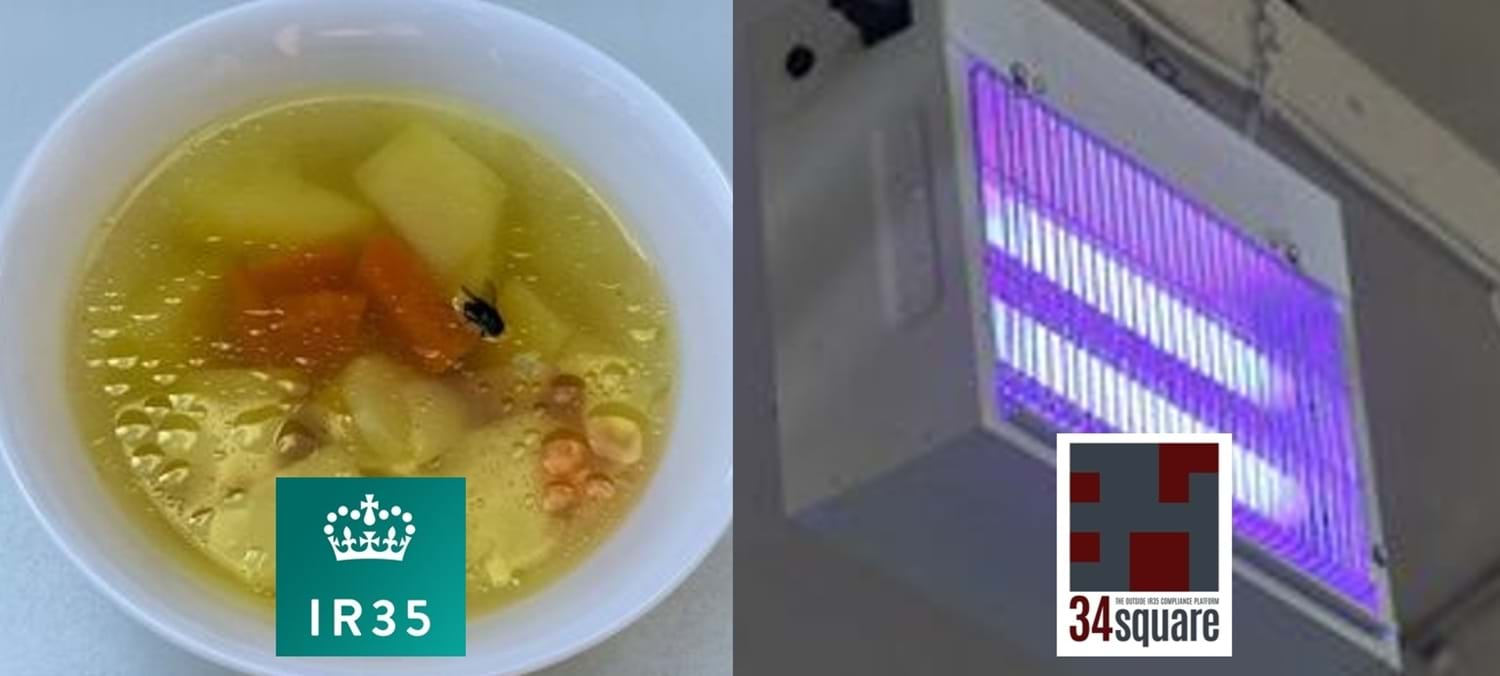

Take a look at https://www.34square.com/status-determination-statements to see how we help clients meet all of your compliance, regulatory and reasonable care obligations It takes just a couple of minutes to generate. Possibly the most robust SDS there is for outside IR35. One hundred percent aligned with the HMRC CEST tool and IR35 tribunal case law precedent. Or would you rather be faced with searching out talent from an army of apathetic, complacent contractors you’ve told to just suck it up? For no justifiable reason? Contractors might be whinging and moaning. Because there really IS a fly in their soup.